Mergers in Minnesota

The FTC and DOJ are considering changes to their merger guidelines, they need to hear from Minnesotans!

In 2004 JP Morgan Chase bought Bank One in a massive $59 billion merger that made Chase the second largest financial institution in the country. My mom worked in a BankOne call center when the merger took place and over the next several years lived in fear of having her job shipped overseas. While that call center survived, the same cannot be said for ones in Kentucky, New York, Ohio and South Carolina that Chase either shuttered or significantly downsized as it moved operations overseas. This is one of the costs of mega mergers.

A merger of this size might have been blocked in an earlier era but was unanimously approved then. In the nearly two decades since, our nation’s financial system has only grown more concentrated with the number of commercial banks in the United States dropping from 14,400 in 1984 to just 4,375 at the end of 2020. This consolidation is not limited to the financial sector as weakened antitrust laws have spurred a multi-decade merger frenzy that has meant lost jobs, higher costs and fewer small businesses in Minnesota.

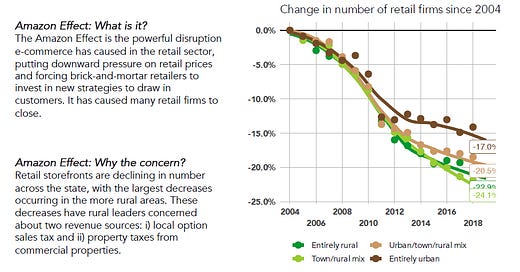

Big Tech giants have acquired hundreds of companies over the past two decades, such as the 116 companies Amazon has gobbled up since 1998. Amazon’s size and power have been a death knell for small businesses, while putting workers in harm’s way. The rate of injury at Amazon’s Shakopee warehouse is five times higher than the statewide rate for private-sector workers, while a study on Amazon’s impact in rural communities found the number of retailers in rural Minnesota has declined by nearly 23 percent since 2004.

Mergers have left just six health systems in control of over half of Minnesota’s hospitals and 65% of the beds. Despite hospital profit margins rising from 7.6% to 9.1% from 2011-2019, the state lost over 300 available hospital beds. That total was before M Health Fairview, itself the product of major mergers, announced in October 2020 that it was shuttering two hospitals and eliminating 900 jobs as a wave of winter COVID hospitalizations lurked around the corner.

In recent years Cleveland Cliffs completed over $2 billion worth of deals to purchase AK Steel and ArcelorMittal, expanding its vertical power over the domestic steel industry. The latter purchase included two Iron Range mines, leaving just two companies, Cliffs and U.S. Steel, in control of each of Minnesota’s mines. This increased power made it easy for Cliffs to settle a royalty dispute at its Northshore Mining facility by idling the plant and laying off over 400 workers, despite $100 million of recent upgrades to the facility.

Across the economy companies have been allowed to grower larger and more powerful. Since the late 1990s over 75% of U.S. industries have become more concentrated and the annual number of mergers reported to the Federal Trade Commission (FTC) has increased from 684 in 2009 to 2,030 in 2019. This wave of consolidation is not inevitable, it is the direct result of policies aimed at undermining protections that safeguarded free and fair markets. Chief among these is the revision of merger guidelines in 1982.

First established in 1968, merger guidelines are a set of internal rules established by the Department of Justice (DOJ) and FTC that help establish what mergers the agencies will scrutinize and challenge. The original merger guidelines established clear market share thresholds and rejected the argument that illegal mergers should be allowed if they create efficiencies. However, in 1982 the merger guidelines were weakened and narrowed to reflect the views of “Chicago School” economists that believed big business was efficient and would provide low prices.

Instead of lowering prices, families across Minnesota are suffering from record inflation with profiteering to blame as pricing power is estimated to account for as much as 70 percent of the past year’s price hikes. Prices are just the beginning of the harms of unchecked consolidation from mergers. Median annual compensation would be more than $10,000 higher if employers were less concentrated. The economy has become less innovative as monopolies destroy new businesses and spend less on basic research. Meanwhile, social media monopolists are tearing our society apart with hate-fueled business models.

Fortunately, something can be done about this. The FTC and DOJ recently announced a plan to revise the current merger guidelines and have asked for the public’s input by the end of TODAY, APRIL 21. For too long the governance of the corporate monopolies that dominate Minnesota, and the rest of the country, has been reserved for economists and lawyers with theoretical models and technical jargon. Now an opportunity exists to lift up the voices of everyday people. There are over 4,700 comments that have been submitted to the FTC and DOJ already! But have they need to hear from you?

Submitting comments to a federal rulemaking can sound like a highly technical task best reserved for expert lawyers or economists, but mergers impact all of us. I submitted comments that shared the story about my mom I opened this piece with. It did not include any sweeping reform proposals, it was just one story that help highlights how mergers are being used to crush us. The good folks at the American Economic Liberties Project have made it super easy to comment with an online tool. So what are you waiting for!

“Do we want an America where the economic marketplace is filled with a few Frankensteins and giants? Or do we want an America where there are thousands upon thousands of small entrepreneurs, independent businessmen, and landholders who can stand on their own feet and talk back to their government or to anyone else?” - Hubert Humphrey in 1952.